Galway Corporate Bank

On the highway, going a little faster gets you to your destination much sooner. Learn how a slightly higher interest rate can help speed you toward your next savings goal or build up your emergency fund with Galway Corporate Bank.

Account features & benefits.

- Life Planning: Build your Life Plan with one of our expert advisors. Start by considering your priorities and goals Working together with your advisor, you can refine your plan and explore different scenarios. Enjoy the peace of mind of knowing that you and your loved ones are on track to bring your dreams to life. You can choose to meet a Life Planning Advisor in-person or remotely, at a time that suits you.

- PENSIONS: Are pensions a mystery to you? You’re not alone – only 40% of people truly understand how they work. Retirement planning is on the minds of 38% of the population, but just 39% are aware of the tax breaks associated with pensions and only 22% seek professional advice about starting one. Join us as we explore the compelling reasons to start a pension plan.

1. You may need an income for up to 30 years after you retire

2. Your income could drop by over 70% when you retire.

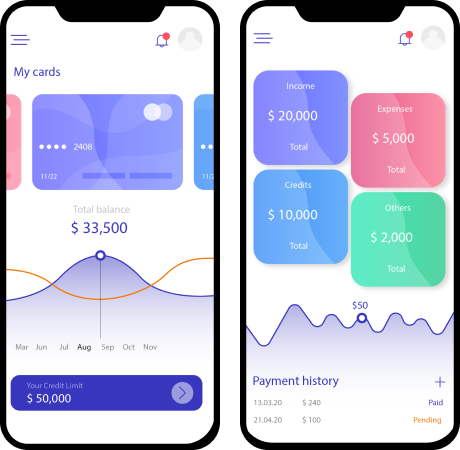

3. It’s a great way to save tax - HELPS YOU CREATE A SAVING HABIT: When every euro you earn seems to be absorbed by expenses, it can sometimes feel as if you simply can't save any money. So how do you take control of your finances and start setting money aside for the future when money is tight and particularly when there is so much financial uncertainty about in these difficult times. Here are 5 steps our personal banking feature can help you create a new savings habit.

1: Choose your savings goal.

2: Work out how much disposable income you have.

3: Figure out how much can you save towards your goal?

4: Set up a separate account for savings.

5: Start saving.