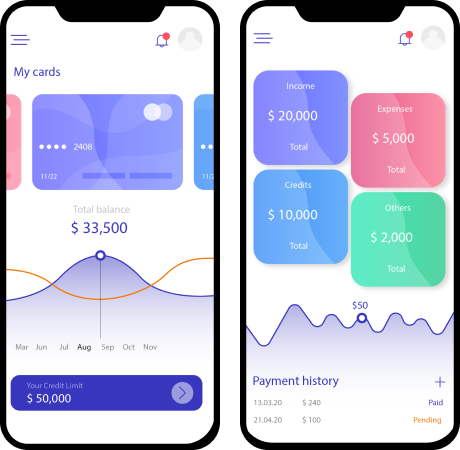

Let's get started on your financial journey.

CAR LOAN

HOME LOAN

BUSINESS LOAN

MEDICAL LOAN

CAR LOAN:

Get motoring Apply online in 15 minutes.

Thinking of upgrading your car to a new model, a powered electric vehicle or a plug in hybrid vehicle? A Green Car Loan with Galway Corporate Bank could get you on the road.

Key Features

- Variable rates from 6.8% APR2

- Amounts from €2,000 - €65,000

- Loan terms from 1 to 5 years

- Flexible repayment options - clear your loan early and pay less interest

- No need to hold any savings against your loan

- Apply online in 15 minutes (existing Galway Corporate Bank online registered customers)

- APR stands for Annual Percentage Rate.

- Variable rate of 6.50% APR1

- Amounts from €2,000 – €65,000

- Loan terms from 1 to 7 years

- Flexible repayment options - clear your loan early and pay less interest

- No need to hold any savings against your loan

- Work being undertaken must include one of the below to qualify for Green home

- Renewable Energy Upgrade (e.g. solar panels)

- Attic/Floor/Wall Insulation

- Pipe Insulation

- Sustainable water/heating systems

- Boiler Upgrade

- Installation of energy efficient controls in the home

- Door/Window Replacement

- Deep retrofit (e.g. as part of the SEAI Deep Retrofit grant)

- Proof of work being undertaken will be required.

- Variable interest rate loans

- Flexible repayment terms

- No arrangement fee

- Apply online in minutes

- Loans from €1,000 to €120,000

- Fixed repayment options

- Variable interest rate loans

- Flexible repayment terms

- No arrangement fee

- Apply online in minutes

- Loans from €1,000 to €500,000

- Fixed repayment options

- Variable interest rate loans

- Flexible repayment terms

- Loans from €120,000 to €500,000

- Tailored to your needs

- Dedicated Business Team

- Use to expand, grow or invest

- Variable interest rate loans

- Flexible repayment terms

- Loans from €120,000 to €500,000

- Tailored to your needs

- Dedicated Agri Team

- Use to expand, grow or invest

- Variable interest rate loans

- Flexible repayment terms

- No arrangement fee

- Apply online in minutes

- Loans from €1,000 to €500,000

- Fixed repayment options

- Loans from €10k-€1m

- Unsecured loans from €10k-€500k

- Loan terms 3 month's to 6 years

- Interest only option

- Variable interest rate loans

- Fund working capital/investment

- Loans from €25k - €3million

- Security may be required

- Loan terms from 7 to 10 years

- Interest only option

- Variable interest rate loans

- Investment in climate action

- Variable interest rates

- Terms between 3 and 7 years

- Flexible repayment terms

- Borrow from €5k to €300k

- To fund energy saving projects

- No arrangement fee

- Release tied up funds

- Enhance your credit standing

- Multicurrency facilities

- Easy & efficient administration

Option to defer first 3 month’s repayments

Rate offered depends on loan amount and may differ from advertised rate. Lending criteria, terms and conditions apply. Over 18s only and not suitable for students. Only banking 365 online registered customers can apply online.

The repayments on a personal loan of €20,000 over 5 years with 60 monthly instalments are €391.92 per month at 6.6% variable (Annual Percentage Rate of Charge (APRC) 6.8%). The total cost of credit is €3,515.20.

Variable rates are correct as at 30th June 2022 and are subject to change.

By deferring your repayments at the start of your agreement you will pay more interest over the loan term than if you started to make repayments from the outset.

HOME LOAN:

Improving your home’s energy efficiency can make it warmer, reduce your energy bills and may make it more attractive to future buyers or tenants.

There are already grants available to help make the changes you need more affordable when you improve your home’s Building Energy Rating (BER). You can find details on the Sustainable Energy Authority of Ireland’s website*.

If you are undertaking work on your home to improve its energy efficiency, you may be able to avail of our Green home improvement loan offering our lowest available variable rate home improvement loan.

Green Home Improvement Loan

Thinking of upgrading your homes energy efficiency? Introducing solar energy? A Green Home Improvement loan with Galway Corporate Bank could help you on your way.Key Features

Option to defer first 3 month’s repayments

Improvement loan:

Rates

Variable rate of 6.50% Annual Percentage Rate (APR) for loans from €2,000 – €65,000 with terms from 1 – 7 years.

The repayments on a Green home improvement loan of €20,000 over 5 years are €389.15 per month based on a variable rate of 6.5% APR. The total cost of credit is €3,349.00. Variable rates are correct as at 30th June 2022 and are subject to change. Lending criteria, terms and conditions apply.

Personal Lending Interest Rates

Here are the reference rates we apply to new business personal lending. These rates apply from 17th July 2019 until further notice.

VI 0.25% The interest rate we charge for a loan may include a margin plus the reference rate. Your credit agreement shows you details of the type of interest rate we charge for your loan.

BUSINESS LOAN:

Finance for Business

We want to make it even easier for you to manage and grow your business. Whether you're purchasing stock or need to expand your business, we're here to help you every step of the way.

Business Loans <= €120,000

We can help with your financial requirements and support your plans to grow or diversify your business.Features

Benefits

Farm Loans <= €120,000:

We understand that you may need to invest in your farm today, so that you can reap the rewards of that investment in the future.

Features

Benefits

Business Loans > €120,000 up to €500,000:

We understand that through various life stages of your business that you may need help financially.

Features

Benefits

Farm Loans > €120,000 up to €500,000:

Features

Benefits

Farm Loans <= €120,000:

We understand that you may need to invest in your farm today, so that you can reap the rewards of that investment in the future.

Features

Benefits

Ukraine Credit Guarantee Scheme

The Ukraine Credit Guarantee Scheme (UCGS) is designed to fund working capital and investments for business impacted by additional costs due to the conflict in Ukraine.

Features

Benefits

Growth and Sustainability Loan Scheme

A long-term low-cost scheme to support eligible businesses, including farmers and fishers, when investing in climate action and environmental sustainability.

Features

Benefits

Green Business Loan

Offering discounted finance to businesses who want to implement energy-saving initiatives in order to reduce their carbon footprint and their costs.

Features

Benefits

Invoice Finance:

Invoice financing solutions enables your business to raise working capital by converting trade debt upfront into cash.

Features

Benefits

MEDICAL LOAN:

Financing for a wide range of health and wellness expenses.

For over 11 years, Galway Corporate Bank has help customers get the care they want for themselves and their families. With partners like VSP, RITE AID, MD SAVE and Care Credit we have been able to come up with reasonable Medical loan plans to suit your needs

Apply For Loans

Welcome to Galway Corporate Bank, Apply For loans to be delivered to your doorstep today.

Apply

Finance your next car

Are you looking for a car loan for a new or used vehicle? In minutes, find out if you're pre-qualified for financing with no influence on your credit score. Also, before visiting a participating dealer, make sure you understand your loan terms.